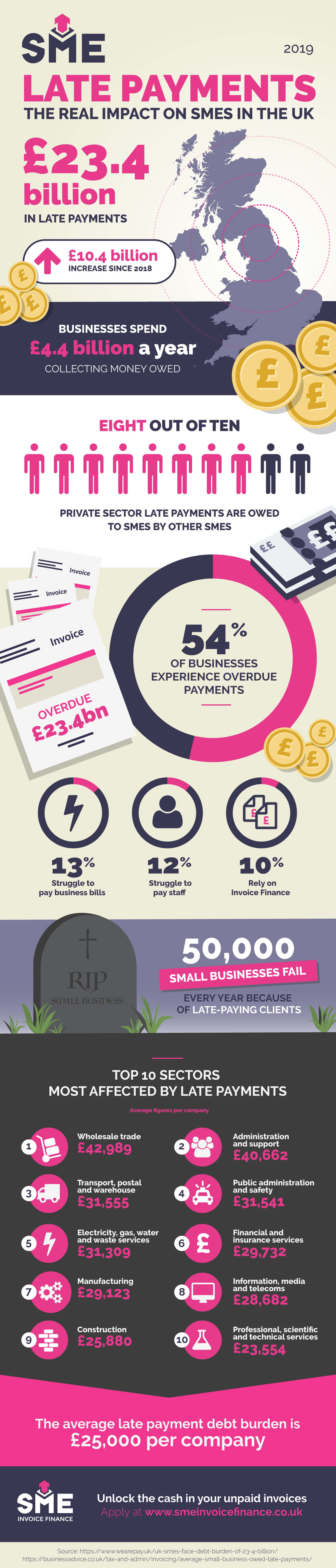

Running a business is difficult enough without having to worry about chasing payments. Unfortunately, late payments are one of the most potent threats to the success of small and medium-sized companies in the UK. The infographic below shows the scale of the problem, with UK SMEs owed £23.4 billion in 2019.

The impact of late payments is more dramatic than before, with the total debt owed to UK SMEs increasing by over £10 billion since 2018. Companies are now spending £4.4 billion every year following up unpaid invoices and collecting outstanding payments. One of the main issues is that businesses often work together, depending on a chain of events to make payments on time. Around 80% of private sector late payments are owed by SMEs to other small businesses. Delays create a domino effect, leaving a network of companies facing difficulties.

Late payments affect over half of UK SMEs (54%) and the consequences can be far-reaching. Thirteen percent of small and medium-sized enterprises struggle to pay bills, 12% have difficulties covering wages and 10% depend on invoice finance.

The implications of outstanding payments should not be underestimated. Approximately 50,000 companies fail each year in the UK as a result of late payments, with those operating in wholesale trade, administration and support and transport and warehousing worst affected. Other industries that are hampered by unpaid debts include public administration and safety, electricity, gas, water and waste, finance and insurance and manufacturing.

The average UK SME has a late payment debt burden of £25,000.

Infographic Design By SME Invoice Finance